Mortgage Process Outsourcing 101 for Brokers and Lenders

Securing VA and FHA Case Numbers On your behalf, we will help you order the VA and FHA case numbers online. We carry out this operation methodically to validate all requests, as incomplete requests may cause delays in the mortgage cycle, affecting your business performance. Prepare and Dispatch Accurate Loan Estimates

Mortgage Process OutsourcingRevolutionizing Loans Processing

Outsource Mortgage Processing to the Expert. Invensis has over two decades of experience delivering top-notch back-office support services to US mortgage companies, brokers, and commercial lending companies. We specialize in various mortgage processing outsourcing services, including loan origination and processing, loan underwriting, quality.

How Mortgage Process Outsourcing Can Helps Lenders?

Most mortgage process outsourcing partners bring expertise in latest technology and have digitalized infrastructure that mortgage lenders can take advantage of. Minimal overhead costs. Financial institutions that opt to run their own loan processing teams find the strategy costly and time-consuming. They have to hire and train a team, pay high.

Reverse Mortgages a Turnaround of the Mortgage Process Hit Cash Now

5 Ways in Which Mortgage Process Outsourcing Benefits Mortgage Lenders The mortgage procedure involves everything from mortgage origination through closure. Unfortunately, due to the changes in the industry policies and the increased demands of borrowers, the mortgage process proves to be tedious for lenders.

Mortgage Process Outsourcing Services Streamline Operations

Mortgage Process Outsourcing - Support we Offer 1 Mortgage Origination and processing 2 Mortgage Underwriting Support 3 Closing, post-closing and servicing Generating and reviewing loan estimates Loan set-up

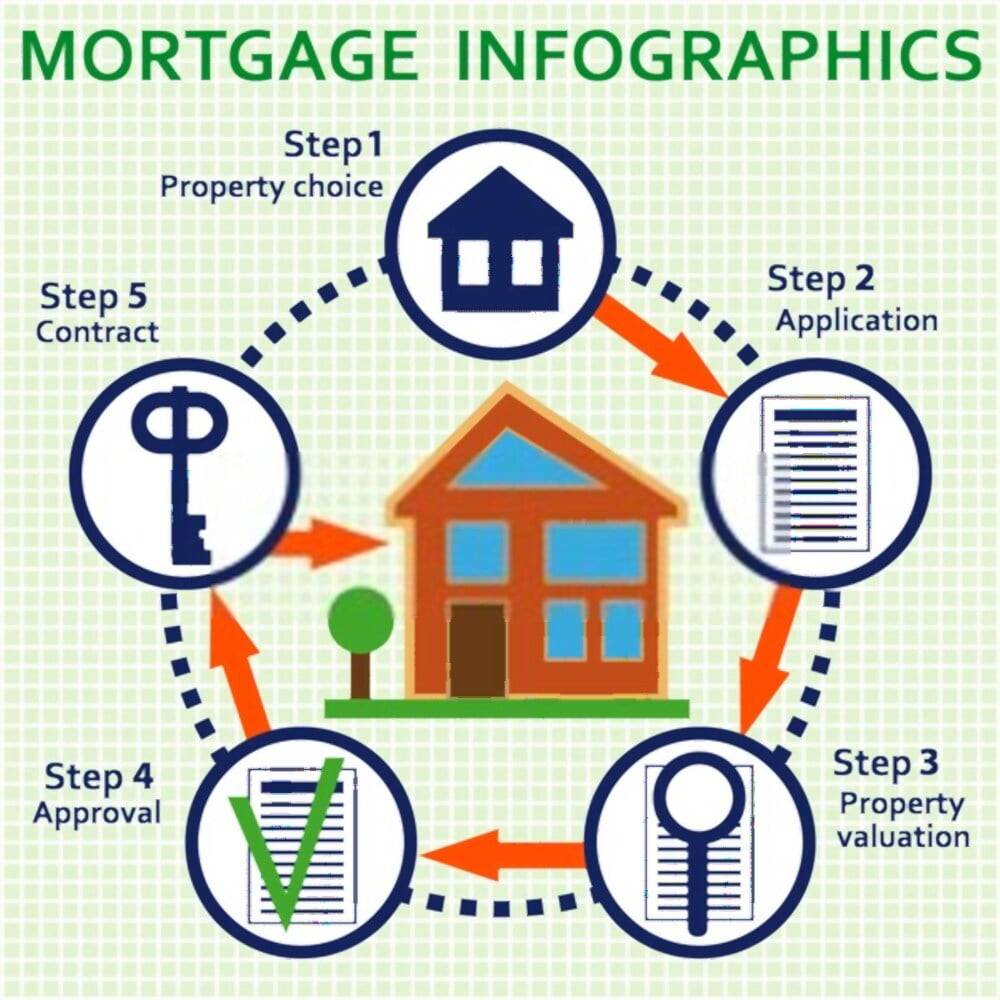

The Mortgage Process An Infographic HUNT Mortgage

Mortgage Process Outsourcing Solutions Delivering value through Intelligent Automation and years of mortgage experience Our Digital First. Digital Now approach empowers lenders and servicers to enhance operational agility - from Lead Generation and Processing to Underwriting, Closing, Post-closing, Servicing and Collections.

eric d schabell from design to execution with jboss bpm

September 14, 2023 Contents Intro Why Outsource Mortgage Process Benefits of Outsourcing Mortgage Process Outsourcing Services In-House vs Outsourced Partner Partner with Aritas In the complex financial sector, mortgage lenders and brokers find themselves navigating an intricate web of processes to provide homebuyers seamless services.

Mortgage Process Outsourcing Services & Solutions

7 factors that create success in Mortgage Process Outsourcing Paramjeetshingh Bhamra Vice President of Solutions Architecture & Presales Categorized: Intelligent Automation, RPA, AI, ML, NLP Estimated reading time : 5 Minutes Share this post

Know The Mortgage Process Before Take The Next Step Toward Home

Conduent Mortgage Services. As one of the original pioneers in business process outsourcing (BPO) and a leader in banking and financial services today, Conduent has deep and diversified expertise across a range of outsourcing solutions. We help financial institutions drive process efficiencies, costs savings and long-term revenue and margin.

PPT How Mortgage Process Outsourcing Can Protect Lenders from ‘The

Article Finance and Accounting Mortgage Process Outsourcing: The Next Wave Towards Better Security Read Time 7 min Author (s) Amit Arya Vice President, Banking and Financial Services, WNS Global Services Download Article Key Points The crisis in the US mortgage industry has had an impact on the outsourcing industry.

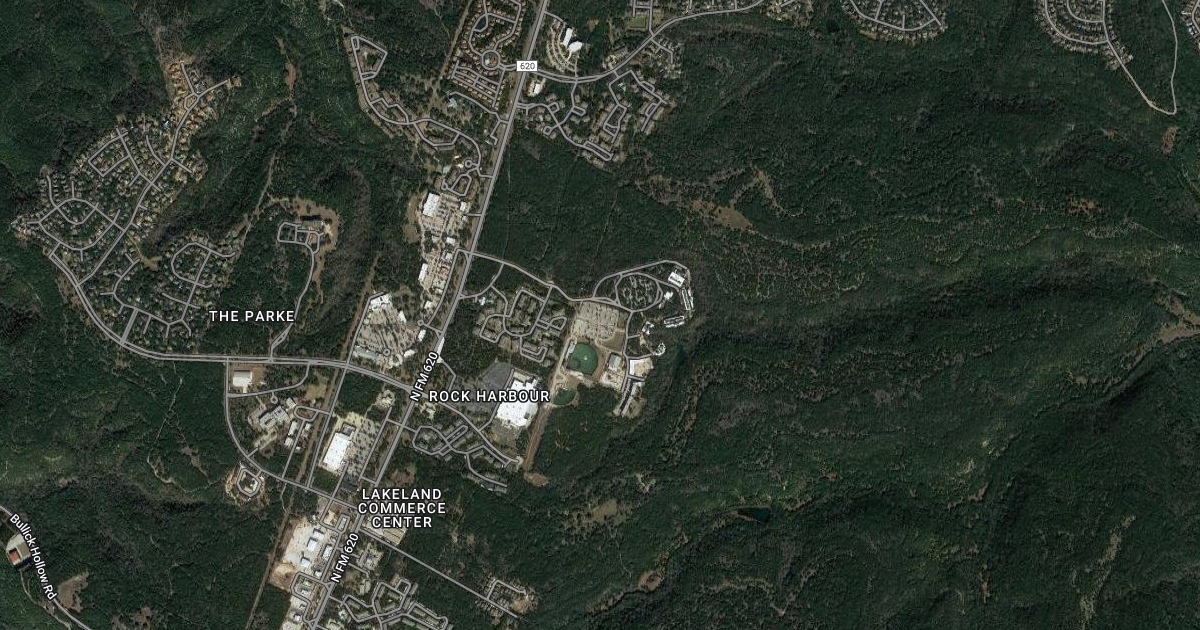

Mortgage Process Outsourcing Scribble Maps

Our Mortgage Business Process Outsourcing (BPO) services help lenders and operators handle volume variability and keep pace with consumer expectations as they evolve. Our distinction?

Infographic An Instant Look At the Mortgage Process

Outsource Your Mortgage Processing Or Underwriting And Save Up To $29,860 Per Employee - Without Sacrificing Speed Or Quality FIND OUT HOW OUR CLIENTS Updated: 26 of August, 2022 Dear Executive/VP,

EasytoUnderstand Infographic on the Mortgage Process Soul Finance Group

Overview Services & Solutions Case studies Insights Connect with us Partner with Sourcepoint for end-to-end mortgage business process outsourcing The post-COVID mortgage market poses significant challenges to lenders and servicers - from navigating continued uncertainty to meeting evolving borrower and regulatory requirements.

Returns of Outsourcing the Mortgage Lending Process

Ever consider Mortgage Outsourcing Services ( a Mortgage BPO) as a solution? Mortgage BPO In 2019 the average US borrower made a 5% down payment for their home purchase. Ten years ago, someone with a down payment that small probably couldn't get a mortgage at all! So, lenders today are taking on more risk in a highly charged, competitive market!

Hire best Mortgage Process Outsourcing Services Provider. Mortgage

Mortgage Business Process Outsourcing & Digital Transformation Solutions. Inefficient mortgage processes? Not with MetaSource in your corner. With mortgage business process outsourcing (BPO) and technology solutions, such as mortgage automation, loan boarding, and mortgage QC audit services, we can help you eliminate process friction, save time, reduce costs, ensure compliance, and unleash.

Seven Factors that Create Success in Mortgage Process Outsourcing

View all Mortgage Professional America, 2022 Top Mortgage Employer NEAT results by NelsonHall Leader in Mortgage and Loan Services 2022 NelsonHall NEAT Mortgage and Loan Services 2022 Report NelsonHall NEAT Mortgage and Loan Services 2022 Report. "Leader". A large US mortgage company automates mortgage loan production and improves efficiency by 30%