The Importance of Storytelling Ability A Wealth of Common Sense

Credit Suisse Global Wealth Report tallies up the number of rich people worldwide. There aren't that many of them in the grand scheme of things. Out of a population of 8.1 billion people, just 62.4 million are millionaires. That's 0.8% of the population. There are 8.4 million people globally with a net worth of $5 million or more.

Wealth Of Common Sense, Ben Carlson 9781119024927 Boeken

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC. More about me here. For disclosure information please see here.

COMMON SENSE PSYCHOLOGY WEALTH Senses, Common sense, Psychology

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC. More about me here. For disclosure information please see here.

How to get through a stock market crash and benefit from it

We talk about all things financial markets, personal finance, our favorite books, movies, and TV shows, parenting, the asset management business and more. Our goal is to make finance more accessible, speak in plain English, and share our own personal experiences in the markets.

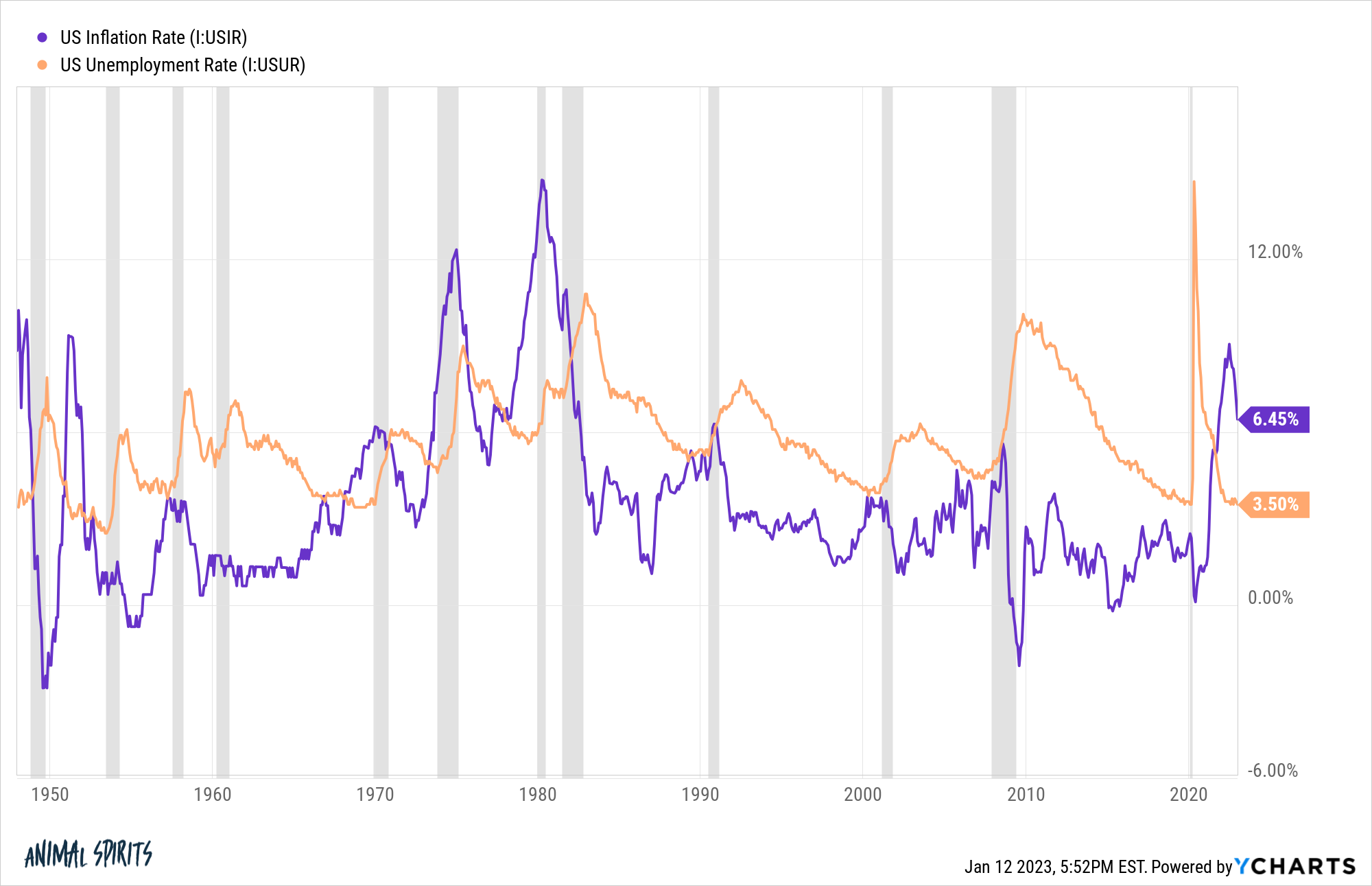

What If We Don't Get a Recession This Year? A Wealth of Common Sense

About - A Wealth of Common Sense About My Background: I'm the Director of Institutional Asset Management at Ritholtz Wealth Management. We create detailed investment plans and manage portfolios for institutions and individuals to help them achieve their goals. I've been managing institutional portfolios for my entire career.

Common Sense Economics What Everyone Should Know about Wealth and

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC. More about me here. For disclosure information please see here.

[Download] A Wealth of Common Sense Why Simplicity Trumps Complexity

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC. More about me here. For disclosure information please see here.

A Wealth of Common Sense Chart, Medical care, Savings account

Bonds have beaten stocks 35 times in a calendar year since 1928. Cash has beaten stocks in 31 out of the past 95 years. So while stocks are your best bet over the long run, over the short run anything can happen. These are the annual returns for each from 1928-2022: Stocks: +9.6%. Bonds: +4.6%. Cash: +3.3%. Long-term investing is great and all.

While this is a very Biblical principle, it is also plain common sense

Bessimbinder found just 86 stocks accounted for half of all wealth creation in the U.S. stock market going back to 1926. All of the wealth creation in that time came from just 4% of stocks. Nearly 60% of stocks failed to beat T-bill returns over their lives. Close to 40% of stocks barely beat T-bills.

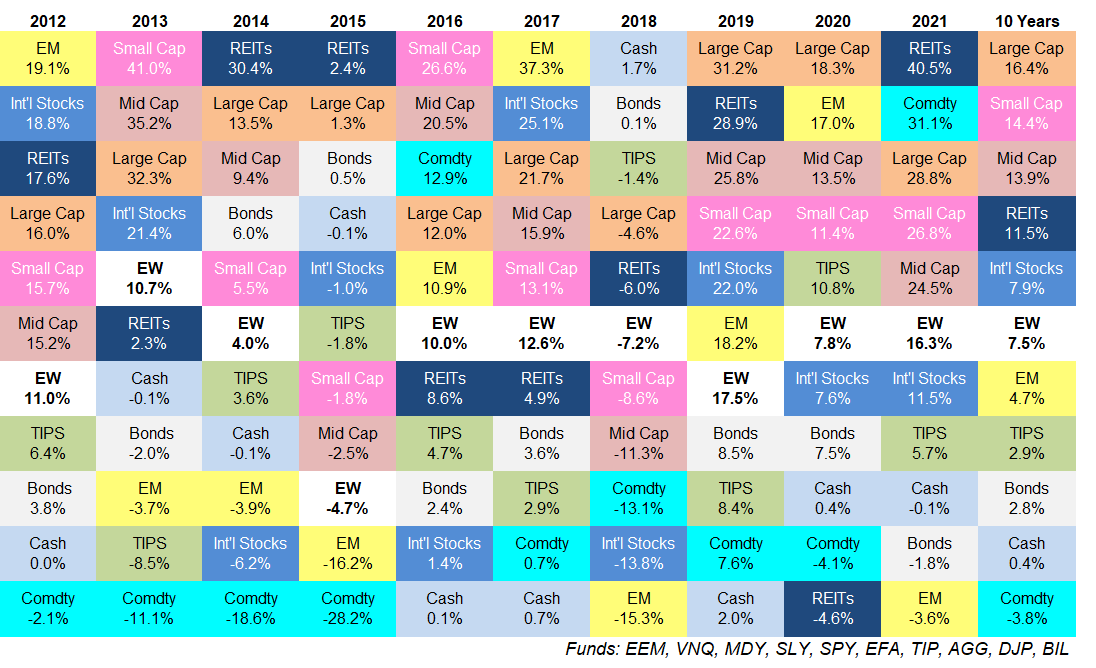

Updating My Favorite Performance Chart For 2021 A Wealth of Common Sense

A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan by Ben Carlson is the last book in my personal finance resolutions for 2020 list of personal finance and investing books to read. Liquid from Liquid Independence recommended this book.Here's my A Wealth of Common Sense book review.. I bought this book on Amazon because I was waiting too long to borrow it from.

Common Sense to Wealth by Jeff Pinkerton (English) Paperback

These seven companies alone are worth more than $12 trillion in market cap. The Wall Street Journal tried to put the Magnificent Seven into perspective: These seven stocks combined are bigger than the stock markets of the United Kingdom, China, France and Japan put together. Apple is roughly the same size as Japan. Microsoft is bigger than the UK.

The Callan Periodic Table of Investment Returns RCM Alternatives

A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan Ben Carlson John Wiley & Sons, Jun 22, 2015 - Business & Economics - 224 pages A simple guide to a smarter.

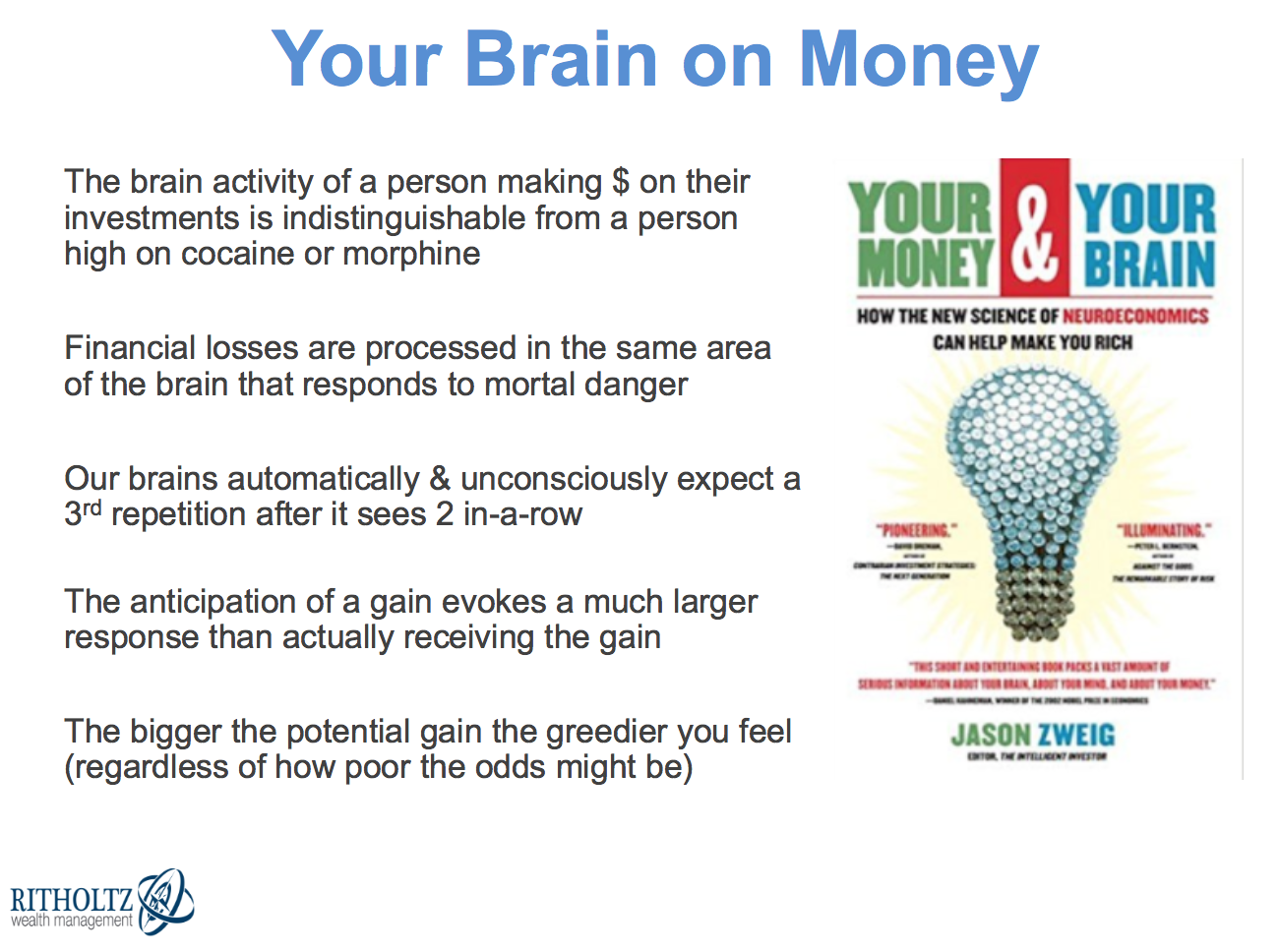

Your Brain on A Wealth of Common Sense

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC. More about me here. For disclosure information please see here.

Talk Your Book Single Stock ETFs A Wealth of Common Sense

My net worth is about $50k. My expenses are about $40k per year and I can typically save about $500 per month. I live in Los Angeles with my partner. For low earning folks who want to be financially stable what advice do you have?

The Nifty Fifty and the Old Normal A Wealth of Common Sense Old

Posted December 3, 2020 by Ben Carlson. Inspired by the new book, How I Invest My Money, I wanted to share how I invest my own money. First of all, the best investment decision I've ever made was developing good savings habits at a young age. For some reason I've always been a saver. Part of it is personality-based.

jobsanger Common Sense

A Wealth of Common Sense sheds a refreshing light on investing, and shows you how a simplicity-based framework can lead to better investment decisions. The financial market is a complex system, but that doesn't mean it requires a complex strategy; in fact, this false premise is the driving force behind many investors' market "mistakes.". Show all